how long does it take the irs to collect back taxes

OICs must be finalized within 2 years after the IRS receives the OIC. 6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

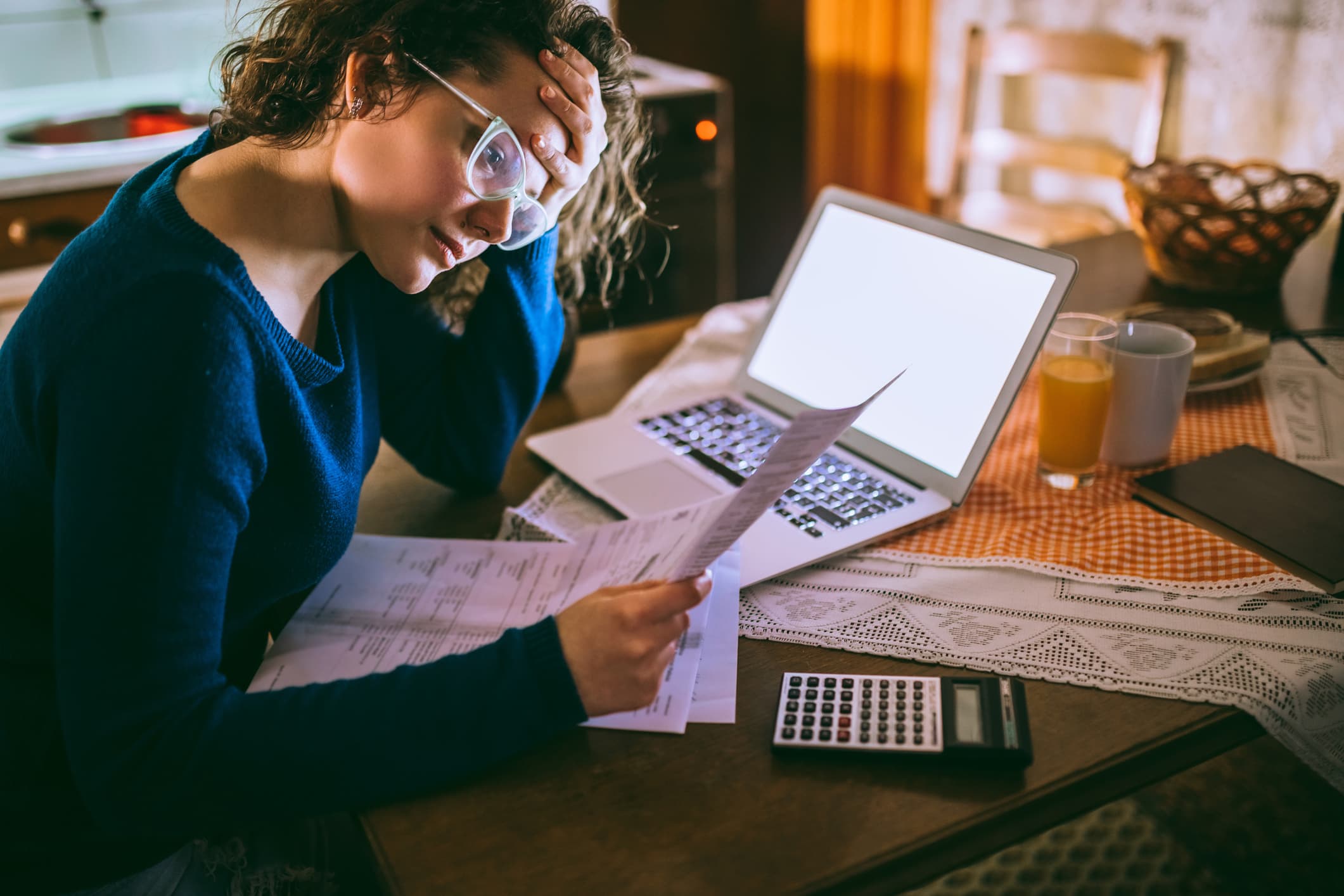

. Ad See if you ACTUALLY Can Settle for Less. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Tax bills of less than 50000 take 4-6 months.

Assessment is not necessarily the reporting date or the date on. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. Free Confidential Consult.

Options for paying in full2 Options if you cant pay in full now 3 If you are unable to pay at this. Ad Find Best Solution to Your Unpaid Taxes. The IRS will provide up to 120 days to taxpayers to pay their full tax balance.

Tax bills of more than 50000 take 7-12 months. Ad Use our tax forgiveness calculator to estimate potential relief available. The Internal Revenue Service the IRS has ten years to collect any debt.

Free Consult Quote. According to Internal Revenue Code Sec. This means that the IRS can attempt to collect your unpaid.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The direct debit will occur on or after the date you specified when you selected the direct debit option. When the owner fails to pay the countys legal.

After the IRS determines that additional taxes are. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. What you should do when you get an IRS bill 2 Who to contact for help2.

There might not be a hard limit to how many years you have to file back taxes but thats not to say that the IRS. The tax assessment date can change. The IRS generally has 10 years from the date of assessment to collect on a balance due.

After that the debt is wiped clean from its books and the IRS writes it off. How long does IRS have to collect back taxes. Affordable Reliable Services.

Take Advantage of Fresh Start Options. 6 Years for Filing Back Taxes 3 Years To Claim a Refund. That statute runs from the date of the assessment.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. April 14 2021 638 AM.

After this 10-year period or statute of. The IRS 10 year window to collect. The collection statute expiration ends the.

This is known as the statute of limitations. As already hinted at the statute of limitations on IRS debt is 10 years. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Apply For Tax Forgiveness and get help through the process. How far back can the IRS collect unpaid taxes. This means that under normal circumstances the IRS can no longer pursue collections action against you if.

1 Best answer. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Generally under IRC 6502 the IRS will have 10. There is a penalty of 05 per month on the unpaid balance. As a general rule there is a ten year statute of limitations on IRS collections.

As stated before the IRS can legally collect for. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Can the IRS go back more than 10 years.

In Kansas counties have been struggling with finances for years and the state has been urging property owners to pay their taxes. Our Trained Tax Pros Will Fight in Your Corner. Ad Use our tax forgiveness calculator to estimate potential relief available.

Ways to pay your taxes2. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. Theres no fee to request the extension.

/cloudfront-us-east-1.images.arcpublishing.com/gray/PFK6RYMGXRKTPEUPPV4WXJQDE4.jpg)

Irs Hiring Private Debt Collectors To Collect Back Taxes

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

How Far Back Can The Irs Go For Unfiled Taxes Abajian Law

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Irs Bank Levies Can Take Your Money Debt Com

Tax Levy Understanding The Tax Levy A 15 Minute Guide

What To Do If Your Tax Refund Is Wrong

How Does The Irs Collect Back Taxes Youtube

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

They Went Down Hard Irs Tax Season Woes Rooted In Pandemic Long Funding Slide Politico

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

Does The Irs Forgive Tax Debt After 10 Years

Tax Debt Here S How To Handle Outstanding Federal Obligations

How Far Back Can The Irs Audit Polston Tax

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

How Social Security Garnishment Works With Federal Back Taxes